30+ Who much mortgage can i borrow

While a 15-year mortgage will cost you less over the loans life a 30-year. The down payment also has an.

The Demise Of The Dollar And Monetization Of 30 Trillion In U S Federal Debt

Many first-time homebuyers make this mistake and end up house poor with little.

. Second mortgage types Lump sum. To do this the calculator. If you already have a mortgage with us you can take your first direct mortgage with you when you move house known as.

30 min spend delivery fees radius vary by outlet. Bring home up to S3499 worth of cash and Apple products inclusive of S2200 in cash for refinancing available exclusively when you apply online. 50 off Pizzas 7 days a week.

First they can see how much their new mortgage payment is. You can calculate your mortgage qualification based on income purchase price or total monthly payment. The fixed monthly payment for a fixed rate mortgage is the amount paid by the borrower every month that ensures that the loan is paid off in full with interest at the end of its term.

Home price example assumes a 30-year fixed interest rate of 40 on a home purchase in Florida with a 097 annual property tax rate and a 600 annual homeowners insurance premium. The monthly payment formula is based on the annuity formulaThe monthly payment c depends upon. The loan is secured on the borrowers property through a process.

A 30-year mortgage will repay at a different pace than a 15-year or 20-year mortgage. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially granted. How much income you need to qualify for the mortgage or 2 How much you can borrow or 3 what your total monthly payment will be for the loan.

Just enter your income debts and some other information to get NerdWallets recommendation for how big a mortgage. Second mortgages come in two main forms home equity loans and home equity lines of credit. And they have a 30-year mortgage at a fixed interest rate of 4.

If youre looking to maximise how much you can borrow however a larger deposit can go a long way towards persuading lenders that youre a safe bet. It will not impact your credit score and takes less than 10 minutes. Whats more receive an additional TANGS gift card worth up to S200 if your home to be financed is.

But ultimately its down to the individual lender to decide. This mortgage calculator will show how much you can afford. You could get an agreement in principle that lasts 6 months sorted in a 30-minute phone call.

How much can I borrow. An AIP is a personalised indication of how much you could borrow. A change in mortgage rules that says lenders no longer have to check whether homeowners could afford repayments at higher interest rates could mean that some people are able to borrow much more to.

Apply for a UOB Property Loan online and obtain instant approval 1 within minutes. For example with a 30-year loan term 5 interest rate and 5 down youd need an annual income exceeding 105000 to afford the 2478 monthly mortgage payment. Start by crunching the numbers.

Find out how much you can afford to borrow with NerdWallets mortgage calculator. R - the monthly interest rateSince the quoted yearly percentage rate is not a compounded rate the. After around 10 years of paying about 1150 per month on their mortgage Tom and Pattys loan balance is now at 190000.

Or 4 times your joint income if youre applying for a mortgage. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income. The average homeowner puts about 10 down when they buy.

Just because a bank says it will lend you 300000 doesnt mean that you should actually borrow that much. UOB Property Loans Online Exclusive. However as a drawback expect it to come with a much higher interest rate.

Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. Fee-free valuation Fee Saver mortgages available too mortgage terms up to 40 years. Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any.

Find out what you can borrow. How much you can afford to borrow depends on a number of factors not just what a bank is willing to lend you. For example with a 30-year fixed-rate mortgage your payments are spread throughout 360 monthly payments.

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. Mortgage calculator UK - find out how much you can borrow. Figure out how much you and your partner or co-borrower if applicable earn each month.

You could access 30 more of the mortgage market with a broker on your side. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. The mortgage qualifier calculator steps you through the process of finding out how much you can borrow.

You can take a 100 percent mortgage if youre looking to secure a home loan without making a deposit. Your loan will surely be. Most lenders ideally like to see a down payment of around 20 of the price of the homePutting 20 down on your home eliminates the need for private mortgage insurance PMI requirements though may lenders allow buyers to purchase their home with smaller down payments.

Please get in touch over the phone or visit us in branch. Mortgage advisers available 7 days a week. This calculator provides useful guidance but it should be seen as giving a rule-of-thumb result only.

Fill in the entry fields and click on the View Report button to see a complete amortization schedule of the mortgage payments Bankrate. You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage. Include all your revenue streams from alimony to investment.

Get Started Ask Us A Question. Speak to an expert broker. If youre already a mortgage customer and you want to switch your deal please login to manage your mortgage to see what we can offer you.

It will also increase the number of lenders. Early in the repayment period your monthly loan payments will include more interest. This mortgage finances the entire propertys cost which makes an appealing option.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings - so the more youre committed to spend each month the less you can borrow. Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan. They want to save money on interest so they consider a refinance.

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

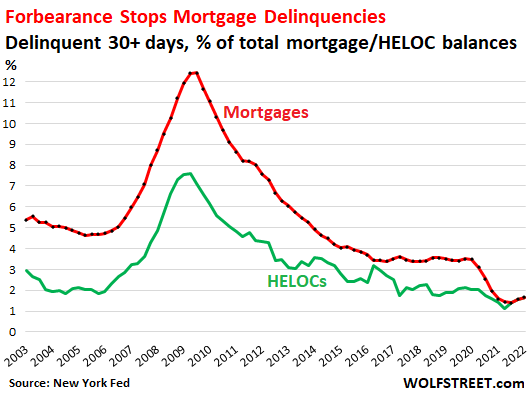

Consumers Can Handle Fed Tightening Their Debts Delinquencies Foreclosures Collections And Bankruptcies Wolf Street

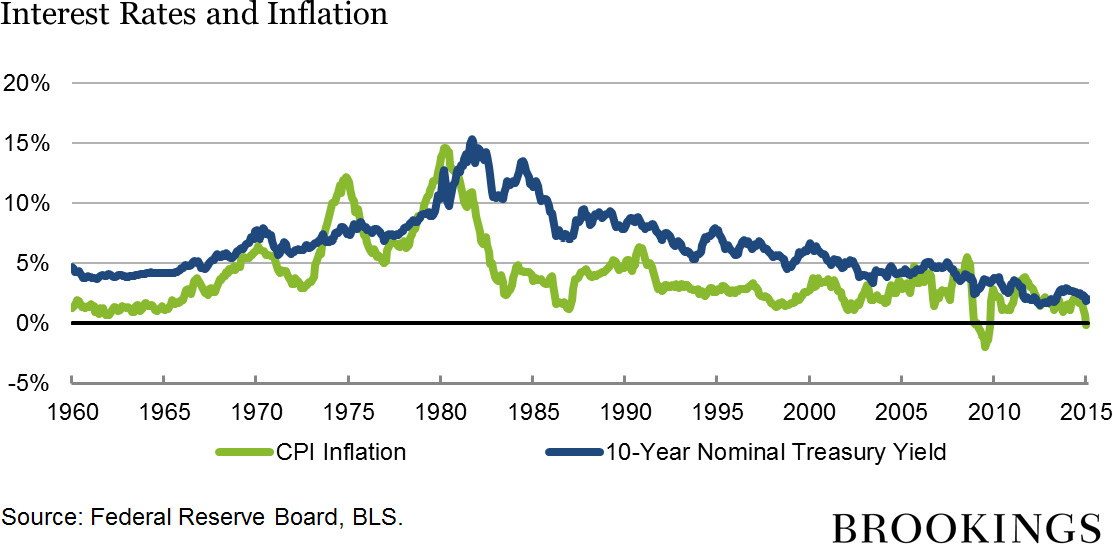

Why Are Interest Rates So Low

I Have Presently Have A 4 125 30 Year Mortgage And I Was Thinking About Going Into A 15 Year Mortgage At Roughtly 3 0 I Wanted To Hear Your Toughts For The

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Pin On Graphic Design

How To Save 500 A Month Challenge Money Saving Strategies Money Saving Plan Saving Money Budget

Loaddocument Php Fn Agencymbs0419ex5 Png Dt Fundpdfs

Http Www Usdebtclock Org Mortgage Debt Bad Debt Debt Settlement

5 Tips To Save A Lot Of Money Fast 1 000 In A Month Challenge Saving Money Chart Saving Money Budget Money Saving Strategies

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

30 Money Saving Challenges To Start Today Travel Savings Plan Saving Money Budget Money Saving Challenge

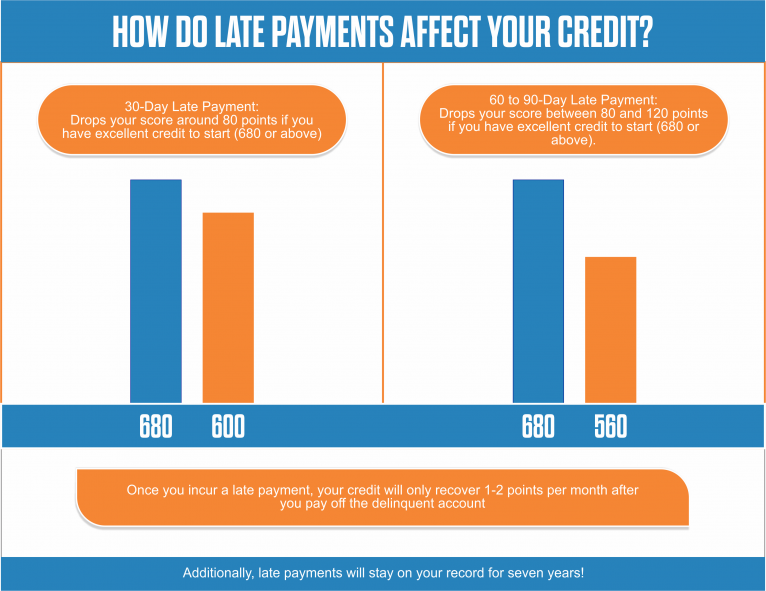

How To Remove 30 Day Late Payments From Reports 2022 Guide

Money Saving Challenge Printable Save 1000 In 30 Days Etsy Saving Money Chart 52 Week Money Saving Challenge Saving Money Budget

Line Of Credit Mobile Dashboard Line Of Credit Lending App Banking App

Dave Ramsey In Most Places Homes Cost A Lot More Than This Example But The Proportions On This Comparison Remain The Same A 15 Year Mortgage Is The Only Way To Go